SOPTICS ESG White Paper

The ESG Challenge with Environmental, Social and Governance (ESG), as a topic, is growing in importance among consumers and businesses. On the back of the COP26 climate conference and other international climate change and social equality reports, there is a dawning realization that urgent action is required to step up and tackle problems in relation to ESG issues. ESG introduces three types of risk for enterprises: reputational, regulatory, and commercial.

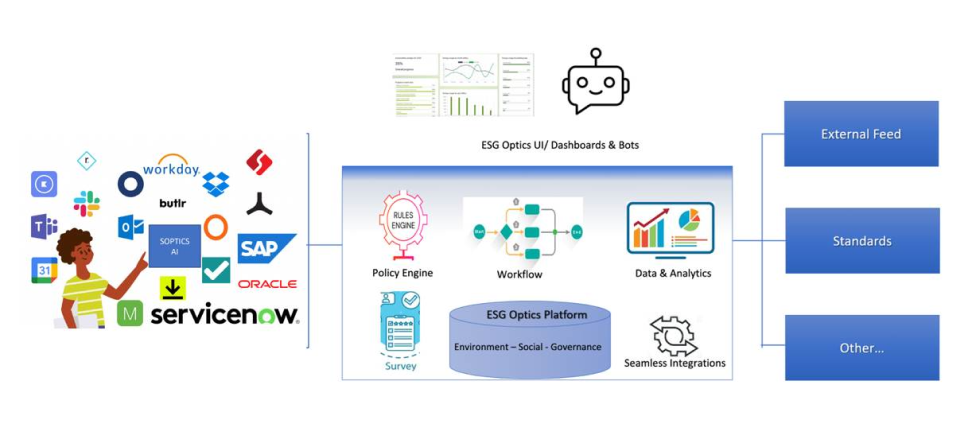

SOPTICS ESG Solution Architecture

With ESG regulatory obligations moving from voluntary standards to mandatory requirements, this can result in the increase of customers and shareholder value, improving standardization and return on sustainable investments. In some jurisdictions, firms may miss out on the beneficial tax treatments and funding opportunities available to ESG-positive firms, such as the 501a Capital Relief. Whilst the number of financial institutions integrating ESG practices into their business and decision-making is slowly increasing, very few have a standardized, business-wide technology strategy to support their ESG operational and compliance goals. ESG Optics quickly creating a compelling competitive advantage that can capture the minds, hearts, and wallet share of their customer base.

SOPTICS is a SaaS-based solution that enables organizations to easily and efficiently fulfill ESG regulatory obligations. Pre-packaged with a dedicated ESG framework, the solution guides your teams through compliance with the necessary regulatory requirements in a series of simple, intuitive steps, including:

- ESG Goals, data and document requirements

- ESG ratings and risk assessments

- Optimize efficiencies and reduce silos between operational teams

- Incorporate dynamic, rules driven, dedicated ESG data capture, document requirement and related party rules into existing operating models

- Identify and visualize supply chain hierarchies and officers through "ESG Optics"

SOPTICS is built using best practice ESG models that enable firms to:

- Simplify ESG ratings using SOPTICS's ESG Entity Classification calculator, to dynamically assign individual and aggregate E, S and G ratings to each entity.

- Automatically calculate climate risk, reputational risk and complementary ESG risks with SOPTICS Risk & Policy engine.

- API-First, Automated ESG Data Sourcing & Integration.

- Integrate seamlessly into any technology landscape, enabling the centralization and management of ESG compliance across multiple business lines and channels, including client outreach platforms.

- Empower your operational and compliance teams to easily and efficiently re-use existing client and related party data from existing KYC and MDM systems.

- Easily and instantly make changes to ratings models, data sets, workflows and more, to fit with your organization's operating model, without needing IT support.

- Provide a full audit of all configuration changes through versioning, subject to governance controls as defined by your organization, enabling you to easily evidence model changes to auditors.

With SOPTICS, you can future-proof compliance with upcoming additions and amendments to ESG-related regulations, including SFDR, TCFD, CSRD and more.

Our team of regulatory experts continuously monitor the ESG regulatory landscape, giving your organization peace of mind with future-proofed compliance and coverage for evolving ESG regulations.

Efficiently adopt ESG into your organization by consolidating and eliminate silos. Increased automation reduces manual rekeying of data from various data sources and systems, improving process and data accuracy. SOPTICS enables your firm to unlock the potential to retain existing customers and attract new clients who are increasingly becoming socially and environmentally conscious in their products and service offerings.